Who Are UK Clean-Tech Octopus Energy?

Origin Energy Picks A Unicorn Renewables Retailer As Partner

Hi there,

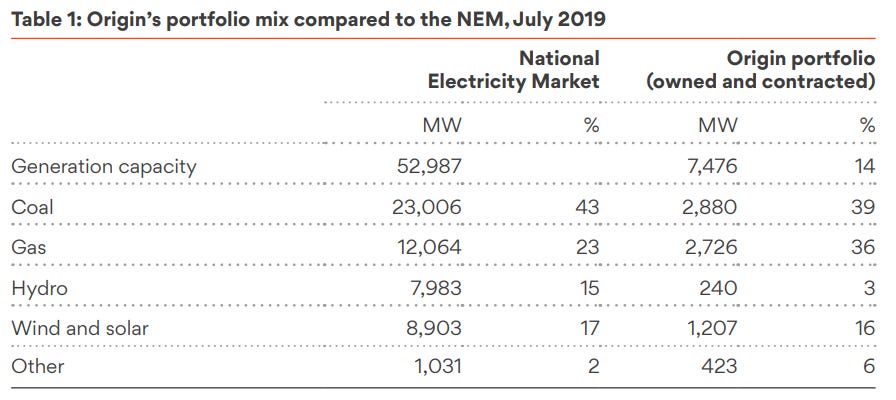

In today’s newsletter, I take a look at the Octopus Energy deal that Origin Energy announced to the ASX on Friday. It’s a bold choice of partner for both companies, given Origin Energy’s energy generation mix is 75% coal and gas as shown in their most recent sustainability report.

Disruption is easy to talk about, but harder to execute. But it reads as if Origin Energy has made a clear choice to focus on improving their overall sustainability performance. They have a goal of 25% renewables generation by FY20 and have started building solar farms in Queensland and South Australia.

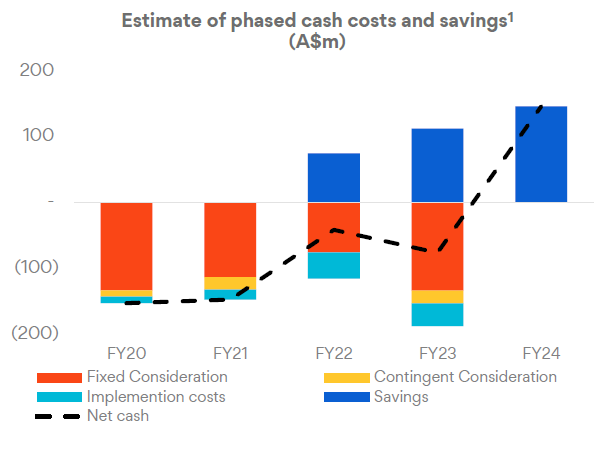

On Friday, energy provider Origin Energy announced it had entered into a strategic partnership with the UK’s Octopus Energy. They said they would buy 20% of the company for A$134 million (£70 million) and spend ~A$373 million (£195 million) over the next four financial years.

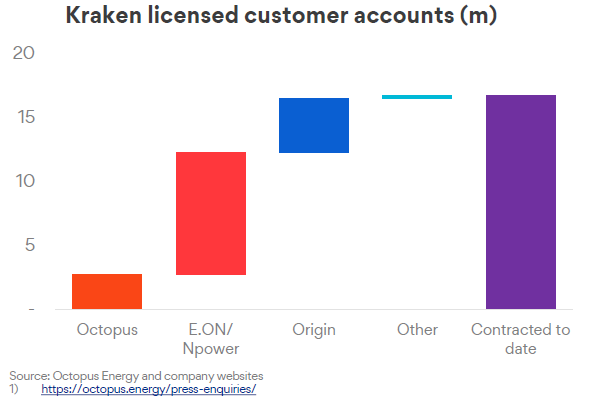

In exchange, they will have a technology partner to deliver a new operating model that will let them provide better customer experiences and reduce operating costs. They will also have a stake in a rapidly growing “clean-tech” energy provider in the UK, Australia and Europe that is on track to have nearly 17 million licensed users of the technology.

Who is Octopus Energy?

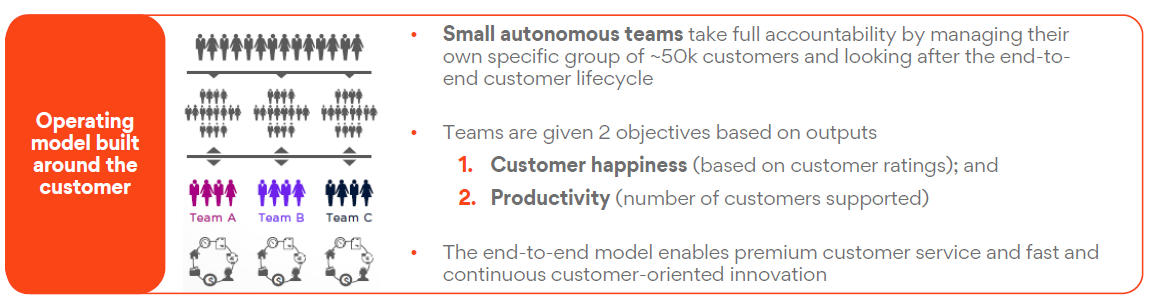

This recent interview with Octopus Energy’s CEO Greg Jackson is dated April 25th 2020. One of the highlights explained here is the operating model they use. Greg Jackson says that about 10 Octopus staffers are responsible for managing about 70,000 customer accounts. The same ten people will always deal with your customer queries. This is how the operating model is described in the ASX announcement:

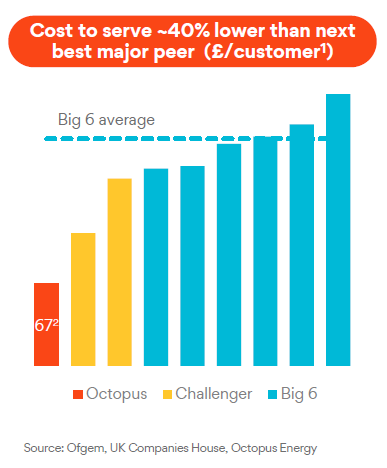

Customers feel like they have a better relationship with their energy provider. This difference between standard call centre models results in lower customer churn, fewer complaints and higher customer satisfaction. This approach seems to have paid off for Octopus Energy, as they have captured 5% of the UK retail energy market. They are also able to obtain a cost to serve lower than their UK peers.

Octopus Energy state in their press release that they will start a “Future Energy Research Centre” to accelerate the speed of the global renewable energy transition. Octopus Energy has built a technology platform called “Kraken” that powers its retail operations. The deal with Origin Energy is a licensing deal for Australia so that Origin can replace its SAP platform with Kraken.

According to UK Companies House records, Jon Briskin, Origin’s Executive General Manager for Retail, became a director of 6 Octopus Energy entities on May 1st 2020. These appointments give Origin Energy active board representation as noted in their ASX announcement. There was also a charge registered against Octopus Energy Ltd by Origin Energy.

Who is Octopus Capital?

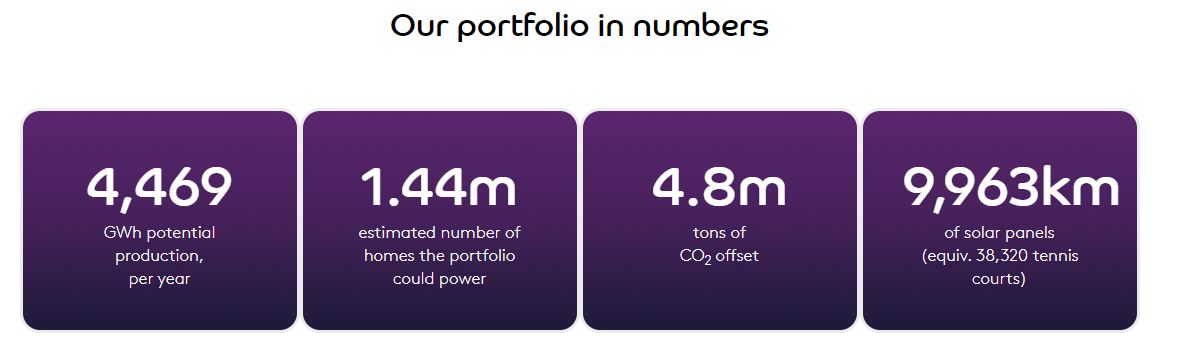

Octopus Energy will still be 60% owned by Octopus Group after this deal. Octopus Group is a large UK investor who has interests in real estate, energy, technology and funds management. Their Octopus Renewables subsidiary manages £3 billion worth of renewable assets.

They also have a company called Octopus Investments, which is building solar farms in Australia.

Our first investment in Australia was Darlington Point Solar Farm, a 333MW DC large-scale solar project near Wagga Wagga in NSW, Australia. The solar farm is currently in construction, expected to be operational by 2020. When built, it will provide clean energy to more than 115,000 households.

Octopus Group CEO Simon Rogerson said of the Origin Energy deal:

We chose Origin because, more than anyone else, they understood our mission to use technology to improve service, drive down costs and make energy greener. Indeed, as part of this partnership, Origin will themselves license the Kraken platform to make their Australian business even more efficient, improve customer experience and support their renewables expansion. We also chose Origin because of the chemistry. We come to work in the morning because we love what we do and it was crucial that we were partnering with people who shared our culture and way of working, as well as our vision.

What does Origin Energy get?

Origin Energy has ambitious sustainability goals. To improve the performance of their retail business, they need to reduce operating costs and embrace new technology. They also need to increase the mix of renewables inside their generation portfolio at pace.

The deal gives Origin Energy a license to use the Kraken platform in Australia. But that’s just the beginning. Configuring a technology platform that works really well in one market (the UK) and adapting it for use in another market (Australia) is expensive and risky. A company called Hanwha Energy was only approved in September 2019 as an electricity retailer and has some license arrangement with Octopus Energy already that needs to be resolved. Origin Energy seems to have budgeted for a sizeable transformation spend per their ASX announcement.

The billing and customer relationship management platform Origin Energy will be moving off is reportedly SAP, which they finished moving to in 2014. But SAP licensing costs will still be in Origin Energy’s technology stack, as they use it for finance, procurement, supply chain and enterprise asset management. The overall technology costs will need to be monitored closely, particularly implementation costs of the Kraken technology. A better sense of the enterprise-wide target operating model Origin Energy is aiming for is needed to better assess the risks of a deal like this.

There may also be proprietary processes, integrations, and systems that Origin Energy needs to incorporate into the Kraken platform to deliver a minimum viable service level for the Australian market. Overall, at first blush, this could be a really transformative deal for Origin Energy on the operating model and technology side of the business. However, there is always a lot of risks to be managed carefully through complex technology systems changes.

Managing multi-jurisdictional technology is a major enterprise technology capability, and Octopus Energy will need to be on its game to deliver to Origin Energy’s timeframes and cash cost savings targets. Likewise, Origin Energy will need to be flexible and agile in changing its business processes and operating model to leverage the technology as opposed to any sort of “lift and shift” mindset.

The move to “small, autonomous teams” will be a cultural shift for a large Australian business like Origin Energy. However, reports have noted they’ve made some changes to how internal technology works in the past few years.

Changing your core technology platform and operating model primarily benefits customers through better experiences and more competitive pricing for electricity. There are “social risk” reductions from a simpler customer value proposition with more transparent pricing and billing.

However, until the generation portfolio has significantly more renewables, there will still be objections from many stakeholders about progress made on sustainability outcomes.

The main things to watch are how Origin Energy progresses on moving customers onto this new platform once the “MVP” is done and how their renewables generation changes during the life of the deal. The investment from Origin Energy turned Octopus Energy into a “unicorn” with a billion-pound valuation, so its a big deal for the clean-tech sector globally.

I hope you enjoyed this note.

Please comment on this newsletter or message me on Twitter if you have feedback.

Regards,

Brennan

Disclaimer: Please Do Your Own Research, This Is Not Advice