What Is The Greenhouse Gas Protocol?

The ESG Alphabet Soup Series #05. Standardised emissions reporting through the GHG Protocol.

Hi there,

Today I’m continuing the ESG Alphabet Soup series with a brief overview of the Greenhouse Gas Protocol.

Regards,

Brennan

The GHG Protocol

The Greenhouse Gas (GHG) Protocol is a framework for measuring, reporting and managing greenhouse gas emissions. It is over 20 years old and was founded in partnership between the World Resources Institute and World Business Council for Sustainable Development.

The first edition of the Corporate Standard, published in 2001, has been updated with additional guidance that clarifies how companies can measure emissions from electricity and other energy purchases, and account for emissions from throughout their value chains. GHG Protocol also developed a suite of calculation tools to assist companies in calculating their greenhouse gas emissions and measure the benefits of climate change mitigation projects.

The most interesting thing about the Greenhouse Gas Protocol is that none of this is new - it’s just getting a lot more attention recently as ESG investing has exploded in popularity over the past few years.

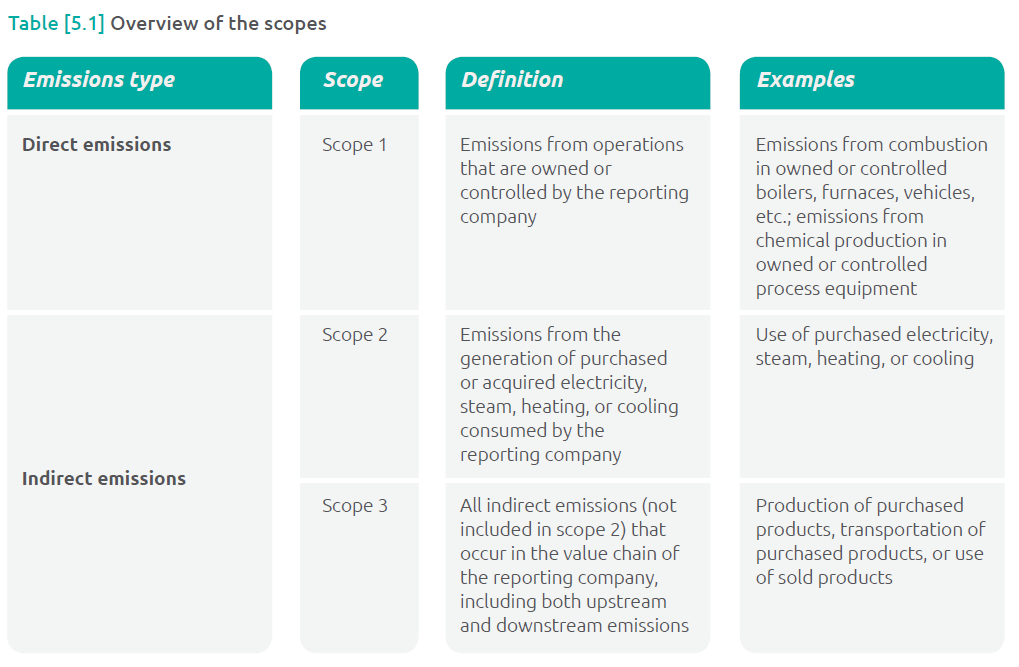

There are three types of emissions under this reporting standard:

Scope 1 - Direct Emissions

All direct greenhouse gas emissions from the entity.

Scope 2 - Indirect Energy Emissions

All indirect greenhouse gas emissions from the energy the company purchases - heat, electricity, steam.

Scope 3 - Value Chain Emissions

All other indirect greenhouse gas emissions not covered in Scope 2, or value chain emissions.

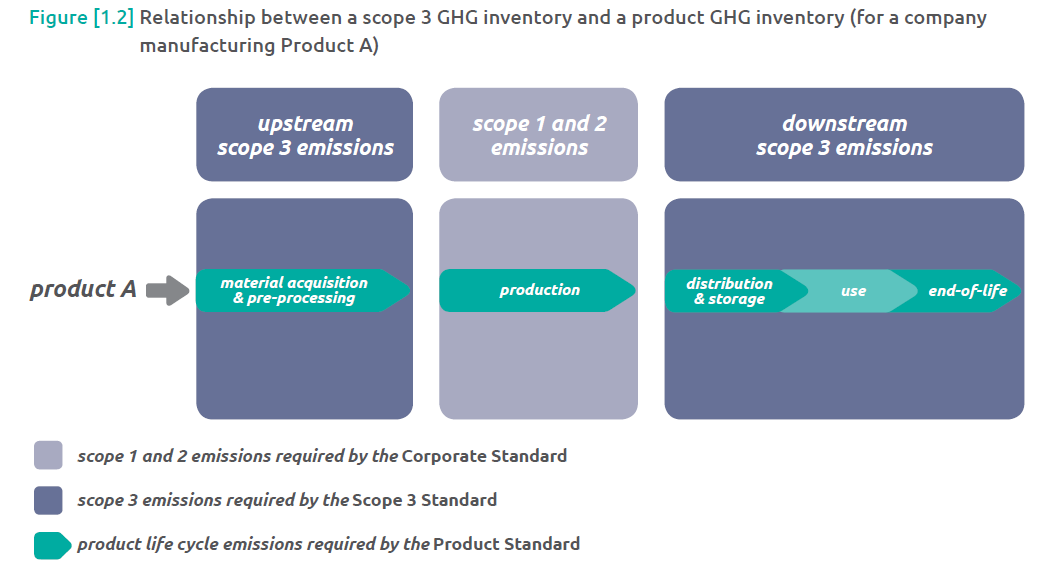

An effective corporate climate change strategy requires a detailed understanding of a company’s GHG impact. A corporate GHG inventory is the tool to provide such an understanding. It allows companies to take into account their emissions-related risks and opportunities and focus company efforts on their greatest GHG impacts. Until recently, companies have focused their attention on emissions from their own operations. But increasingly companies understand the need to also account for GHG emissions along their value chains and product portfolios to comprehensively manage GHG-related risks and opportunities.

These standards are the default for many large private and public sector entities. They are the global standard for carbon emissions accounting.

In 2016, 92% of Fortune 500 companies responding to the CDP used GHG Protocol directly or indirectly through a program based on GHG Protocol.

The GHP Protocol produces tools that enable firms to build their own greenhouse gas emission inventories. They can then use these to calculate their emissions and track them from year to year.

Many listed firms disclose their Scope 1 and Scope 2 emissions already in their reporting. The top performers on ESG measures disclose their estimates of Scope 3 emissions, and increasingly this disclosure will be expected. Many firms still aren’t thinking about how their operating model will need to change to reduce their emissions profile over time.

Additionally, companies may find that there is a reputational risk if they d o not understand the impacts of their broader corporate value chain activities. By undertaking a scope 3 inventory and understanding where their emissions are, companies can credibly communicate to their stakeholders the potential impacts of these emissions and the actions planned or taken to reduce the associated risks.

The normal governance, risk and compliance standards that you would expect of financial reporting should be applied to emissions reporting and disclosure. Assurance through 3rd party audit is a key control for these disclosures.

Over the coming weeks, I’ll continue to work through the ESG Alphabet Soup Series. Next week, I’ll look at the TCFD - Taskforce on Climate-related Financial Disclosures recommendations. If there’s a particular ESG topic you’d like me to cover, please reply to this email and let me know.

The ESG Alphabet Soup Series

Is ESG Investing Just Marketing Spin? [definitions]

Is ESG Investing Just About Climate Change? [environmental factors]

Social Risks, Modern Slavery, And ESG Investing [social factors]

Governance, The Keystone Of ESG Investing [governance factors]