Corporate Purpose Isn't A Marketing Exercise - ESG Weekly Roundup #9

A clear purpose sets the tone from the top that drives the design of a responsible operating model to deliver on the strategy. The board and senior management have to steer clear of platitudes.

Hi there,

A warm welcome to all new subscribers this week! Each Sunday I’m putting together this brief roundup of ESG related content I’ve been reading and watching. I’ll write longer pieces on from time to time on weekdays. You can reply to this note, leave a comment, or message me on Twitter.

Best regards,

Brennan

Reading Time: 7 minutes

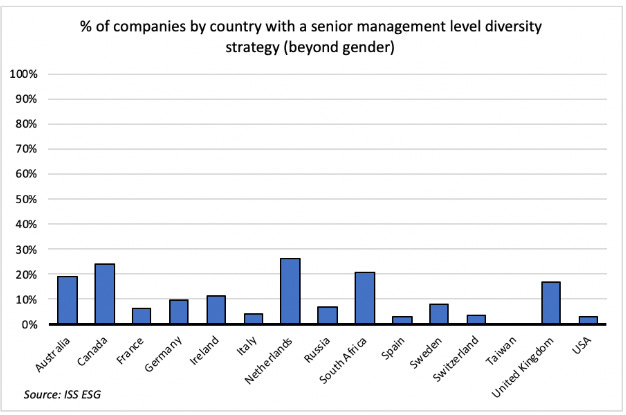

Chart Of The Week

Source: ISS ESG Research

Quote Of The Week

An overwhelming 93% of respondents identify the board as responsible for defining the company’s purpose compared to just 55% that identify the senior management team (including the CEO) as having this responsibility; however, investors identified the management team and the board as equally responsible for implementation. In their engagements with shareholders, board members will need to be able to explain what their corporate purpose is and what was the process to define it, or why they do not believe the concept to be relevant or useful.

Source: Making Corporate Purpose Tangible—A Survey of Investors

What I’ve Been Reading

Beyond ESG incorporation: how the SDGs can help investors shape outcomes in the world:

This report is only the beginning in bringing together thinking on ESG risks and opportunities with thinking on the potential to shape outcomes. The PRI will assist signatories – including through working groups and case studies –across the framework and all investor actions: investment decisions, stewardship of investees and wider stakeholder engagement. To support reporting and disclosure, the revised PRI Reporting Framework – piloting in January 2021 – will include an initial set of questions on outcomes, and collaborate with others on harmonised sustainability performance reporting right across the industry.

The Advantages of Smaller Advisory Firms:

TheFlexShares Advisor Teams and Diversity Study finds that investors are much more likely to work with advisors with whom they share demographic traits—suggesting that firms may benefit if their staffs include advisors with a variety of backgrounds and life experiences.

The study also found that advisors believe offering services beyond investment management will be the second-most-important key to future success, only trailing integrating technology.

Corporate Disclosure of Workforce, Executive, & Board Diversity Strategies by Market:

Just 7.7 percent of the 4,800 analysed companies have a diversity strategy that considers the upper echelons of the business. This drops further in the U.S., where the proportion hits 3.2 percent (compared with 26.1 percent in the Netherlands, 24.2 percent in Canada, 16.8 percent in the U.K., and 19.2 percent in Australia). French companies also fall below the global average at 6.5 percent.

Making Corporate Purpose Tangible—A Survey of Investors:

Calls for a more responsible capitalism have gone louder in recent years. A major shift happened last August 2019 when the Business Roundtable (BRT) published a ‘Statement on the Purpose of a Corporation’. For the first time, the BRT, an organisation that represents the CEOs of America’s largest companies, embraced the concepts of corporate purpose and stakeholder capitalism. This was followed by the World Economic Forum’s Davos Manifesto which highlighted that a company serves not only its shareholders, but all its stakeholders. Meanwhile, investors are placing greater focus on how companies “create value” for the longer term and what their “purpose” is. They have been progressively integrating environmental, social and governance (ESG) factors in their investment decisions while they have experienced a rise of inflows in their sustainable investing products.

Companies Need to Share More of Their Riches With Workers:

Although it would be unproductive for a board committee to enmesh itself too deeply in the details of worker pay, a solid grasp of essentials is necessary. For example, the committee could ask company management and advisers to identify -- both company wide and along major business lines -- data such as the mean and median pay and benefits package of each quartile of employees, with corresponding data about their function, educational level, skill set and business relevance.

The committee should also collect information on whether there is a race- and gender-pay disparity so that it can work with management to fix it. Importantly, the committee must also consider the company's use of contract labor and whether those workers are fairly treated. This information will also be useful in considering if the company pays a living wage to all of its workers, including contract workers.

Rising Seas Threaten an American Institution: The 30-Year Mortgage:

“Conventional mortgages have survived many financial crises, but they may not survive the climate crisis,” said Jesse Keenan, an associate professor at Tulane University. “This trend also reflects a systematic financial risk for banks and the U.S. taxpayers who ultimately foot the bill.”

What I’ve Been Watching

The ESG Alphabet Soup Series

Is ESG Investing Just Marketing Spin? [definitions]

Is ESG Investing Just About Climate Change? [environmental factors]

Social Risks, Modern Slavery, And ESG Investing [social factors]

Governance, The Keystone Of ESG Investing [governance factors]

What Is The Greenhouse Gas Protocol? [environmental factors]